BSc in Accounting

This Program is accredited by the MFHEA

Degree Overview for Accounting & Finance

Our BSc in Accounting provides students with skills and knowledge required to understand and analyze current accounting issues, and to enable them to pursue successful business, management, and accounting careers in a responsible and sustainable way. Accounting is an ever-growing and necessary tool in the business world that changes with new technological developments.

The BS in Accounting is intended for students wanting to build a solid foundation for the business world that extends opportunities in entrepreneurial, government or corporate career paths.

Entry Requirements for this Program

Admission to any AUM level 6 programs will be based on the following criteria:

Completion of application.

Submission of official transcripts showing that the student will have successfully completed a course of study of MQF level 5 (e.g., US or international high school or equivalent course of study) by the time he or she enrolls at AUM.

High school or MQF level 5 course of study GPA (minimum GPA required 2.5 out of 4.0).

Personal essay, addressing personal goals and expectations.

Scores on standardized test (ACT and/or SAT). AUM may consider eliminating this requirement moving forward, once a substantial body of faculty has been established.

Program Details

Program length:

4 years / Full Time

GPA needed to earn the degree:

2.5 or higher

Pass Rate: 73%

Credits needed to earn the degree:

112 US credists / 225 ECTS

Degree level:

MQF Level 6

Overall Course Objectives

Knowledge

The overall knowledge objective of this program is the acquisition of theory, principles, and procedures of the discipline and professional practice of accountancy, paired with familiarity with the many functional areas of a business and the interrelationships among the functional areas within a business. In particular the program exposes students to the following areas:

- A well-balanced general education background, including sciences, social sciences, written and oral communication,

- Economics (macro and micro),

- Statistics,

- Financial accounting,

- Managerial accounting,

- Finance and banking

- General management, operations management, and management information systems

- Business ethics

- Organizational Behavior

- Marketing and consumer behavior

- Cost accounting

- Tax accounting

- Auditing

- Thorough preparation for US based professional certification.

- An understanding of the profession of accountancy and its role in modern business environments.

- An awareness of the need for continuing intellectual development through either professional or academic means.

Skills

Technical Competence

Learning Objectives:

Undergraduate accounting majors will be able to apply and explain the application of accounting standards and regulation, and where appropriate international accounting standards.

Research Skills

Learning Objectives:

Undergraduate accounting majors will be familiar with various authoritative pronouncements in financial and tax accounting, be able to locate and conduct research using online databases, and be able to resolve accounting issues though their understanding, knowledge, and application of research methods and databases.

Ethical Awareness

Learning Objectives:

Undergraduate accounting majors will be able to recognize ethical issues and, where appropriate, resolve those issues.

Teamwork

Learning Objectives:

Undergraduate accounting majors will effectively contribute to the performance of a multicultural, diverse team.

Critical Thinking

Learning Objectives:

Undergraduate accounting majors will be able to apply accounting knowledge in new and unfamiliar circumstances through a conceptual understanding of accounting policies and theory in order to make informed decisions.

Global Perspective

Learning Objectives:

Undergraduate accounting majors will be able to understand global business issues in general and demonstrate an understanding of international accounting standards in particular

Learning Outcomes

Learning Outcomes

Learning Outcomes for Communication Skills for the whole course,

The learner will be able to:

Written Communications

- Students will demonstrate written communication skills appropriate for general business situations with emphasis on technical accounting contexts.

Oral Communications

- Students will create and effectively deliver oral presentations that are concise and informative and conduct research appropriate to the task at hand.

Learning Outcomes for Learning Skills for the whole course,

The learner will be able to:

- Proceed to graduate work in Accountancy

General Pedagogical Methods

In general, the accounting modules are taught with a mixture of theory and applied practice. Lectures,case studies, and class discussions are the primary pedagogical model. However, pedagogical approaches vary from module to module and are addressed in detail in the description of each module.

GENERAL ASSESSMENT METHODS

Successful Progress Requirement:

Students must maintain a 2.0/4 grade point average throughout the program. Students whose performance fails to maintain this standard will fall into academic probation. A student in academic probation can continue to enrol in new modules for two semesters, while the student is strongly encouraged to retake modules in which grades were unsatisfactory. If the GPA does not reach the required threshold after two semesters of academic probation, the student may be dismissed from the program.

Students are required to obtain a grade of C- or better in each of the course modules outside of the General Education Component. If a student receives a grade below C-, the students must retake the module in order to graduate.

Assessment Methods:

Assessment methods and policies vary according to each module. They are specified in the description of each module. In general, business core modules are assessed by written examinations and homework assignments. Business major modules are assessed by written examinations, homework assignments and case studies or projects.

At the programme level it is difficult to set criteria for grades, as each module will have different types of tasks. In general, performance can be evaluated on the dimensions of conceptual knowledge, use of evidence and clarity.

Conceptual Knowledge

- Demonstrates mastery of concepts

- Demonstrates knowledge of concepts

- Demonstrates familiarity with concepts

- Demonstrates consistent errors with respect to concepts

- Demonstrates no knowledge of concepts

Use of Evidence

- Cites supporting evidence from multiple sources and addresses evidence that contradicts one’s argument

- Cites evidence from more than one source

- Cites evidence only from assigned reading

- Cites evidence incorrectly

- Does not cite evidence

Clarity

- Assigned structure is followed, no grammatical or spelling errors, point is very clear

- Assigned structure is followed, minor errors, point is clear

- Some variances from assigned structure, minor errors, point is hard to follow

- Some variances from assigned structure, major errors, point is not well made

- Structure is not followed, major errors, no obvious point

Graduation Requirements

In order to graduate with Bachelor of Science in Business Administration, a student must have completed all modules listed above, with a cumulative GPA of 2/4.

- A student who earns a cumulative grade point average (GPA) of at least 3.850 will be graduated summa cum laude.

- A student who earns a cumulative GPA of at least 3.700 but no higher than 3.849 will be graduated magna cum laude.

- A student who earns a cumulative GPA of at least 3.500 grade but no higher than 3.699 will be graduated cum laude.

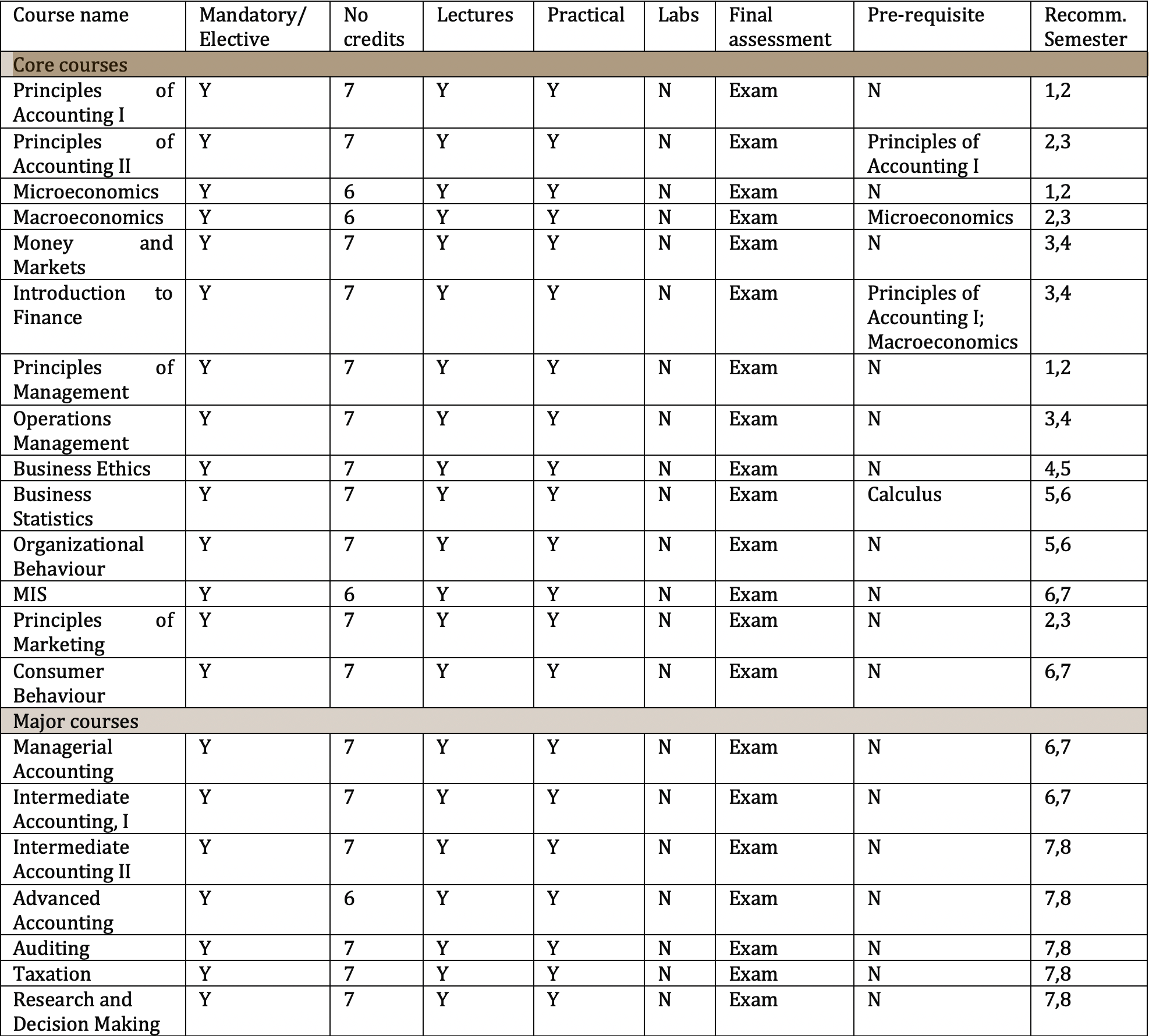

COURSE STRUCTURE SAMPLE

Semester 1 (16 weeks)

- English Composition 1

- Intro to Statistics

- Microeconomics

- General Education (Elective)

- General Education (Elective)

Semester 2 (16 weeks)

- English Composition 2

- General Education Courses (Elective)

- Principles of Accounting I

- Principles of Management

Semester 3 (16 weeks)

- General Education Courses (compulsory)

- General Education Courses (Elective)

- Principles of Accounting II

- Macroeconomics

- Principles of Marketing

Semester 4 (16 weeks)

- Introduction to Finance

- Business Statistics

- Money and Markets

- General Education Courses (compulsory)

- General Education Courses (Elective)

Semester 5 (16 weeks)

- General Education (Elective)

- General Education (Elective)

- Organizational Behaviour

- Operations Management

Semester 6 (16 weeks)

- General Education (Elective)

- Management Information System

- Business Ethics

- Intermediate Accounting I

Semester 7 (16 weeks)

- Consumer Behaviour

- Managerial Accounting

- Intermediate Accounting II

- Advanced Accounting

Semester 8 (16 weeks)

- Auditing

- Taxation

- Research and Decision Making

- General Education (Elective)

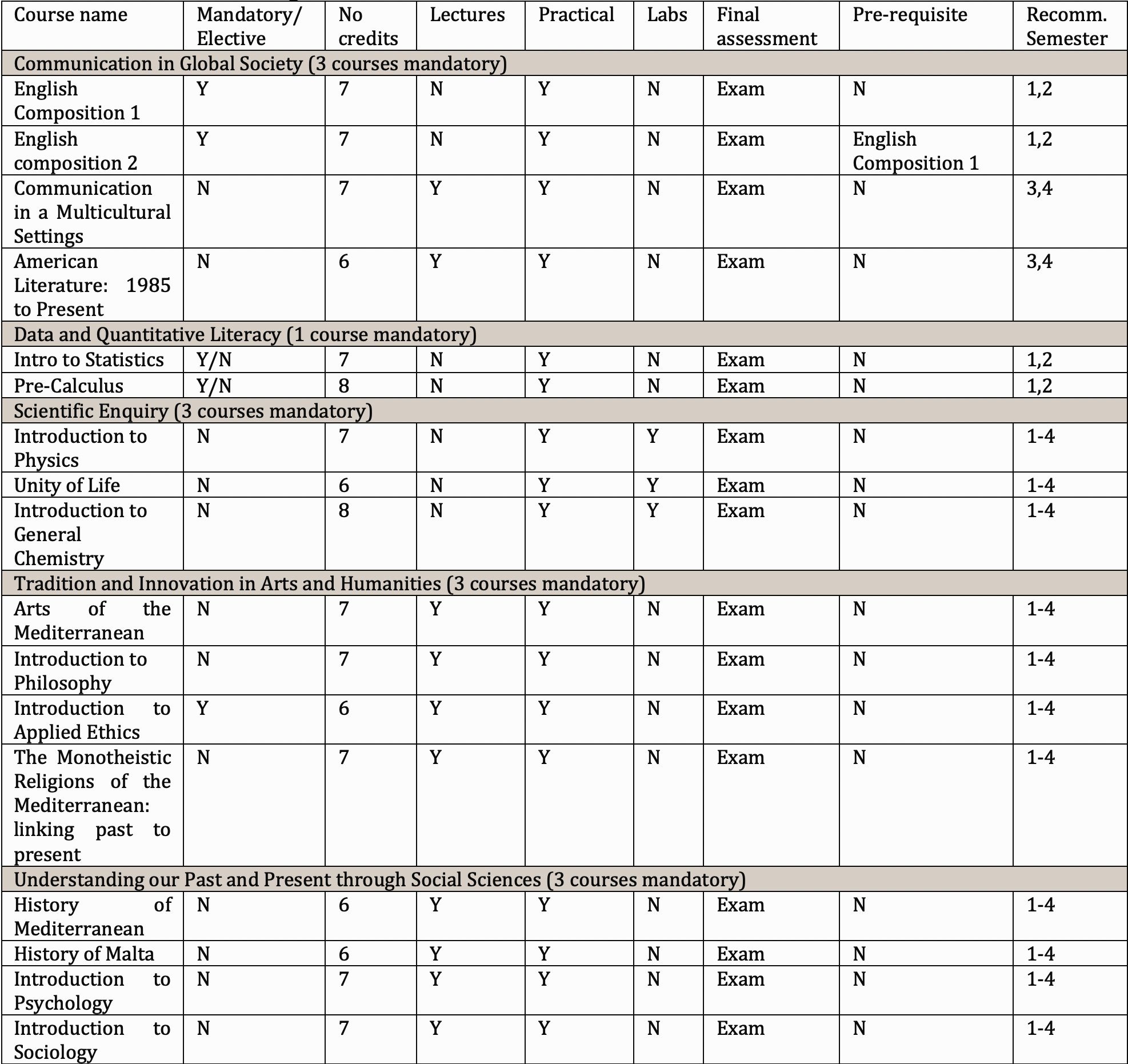

GENERAL EDUCATION