Bachelor of Science in Business & Finance

Degree Overview for Business & Finance

Entry Requirements for this Programs

- Completion of application.

- Submission of official transcripts showing that the student will have successfully completed a course of study of MQF level 4 (e.g. US or international high school or equivalent course of study) by the time he or she enrolls at AUM.

- High school or MQF level 4 course of study GPA (minimum GPA required 2.5 out of 4.0).

- Personal essay, addressing personal goals and expectations.

- Scores on standardized test (ACT and/or SAT). AUM may consider eliminating this requirement moving forward, once a substantial body of faculty has been established.

Program Details

Program length:

4 years / Full-Time

GPA needed to earn the degree:

2.0 or higher

Credits needed to earn the degree:

109 US credists / 218 ECTS

Degree level:

MQF Level 6

Pass Rate:

73%

Overall Course Objectives

Graduates of this program will have a solid foundation for a career in any area of finance. The solid foundation in corporate finance, investments, portfolio management, and international finance will give the student a strong content background. In addition, students will develop communication and presentation skills, active listening skills, the ability to do software analysis, as well as development of teamwork skills and a solid ethical foundation. All students majoring in business must complete the core curriculum which provides the foundation for all majors.

Knowledge

Skills

- Teamwork skills

- Collaborate for effective presentations and analysis in diverse teams, and develop the interpersonal skills and the ability to work effectively with others.

- Quantitative Reasoning and Financial Analysis Skills

- Demonstrate the ability to perform basic financial analysis.

- Research and Computer Skills

- Research complex financial reports and synthesize the results. The use of appropriate software, in particular SAS and Microsoft Excel, will demonstrate their proficiency in software for business applications for research and reporting of results.

- Global Perspectives

- Demonstrate an understanding of global dimensions of business including socio-cultural, political-legal, financial, technological and economic environments.

- Effectively function in the diverse nature of the local and global society and translate that knowledge into improved decision making.

- Work effectively in diverse teams to reach sound financial decisions

- Ethical Reasoning

- Possess the skills to make decisions grounded in ethical thinking.

- Specific Finance skills

- Articulate and apply the principal theories of finance

- Apply financial models and analytical tools to solve problems and guide financial decisions

Competences

- Collaborate as part of a team to solve financial related problems.

- Guide financial decisions of a medium size business, operating in conventional financial environments.

- Be responsible for ethical decisions in financial matters.

Learning Outcomes

Learning Outcomes

The learner will be able to:

Written Communications

Demonstrate written communication skills appropriate for business situations in general and financial situations in particular, this would include research reports and analysis of financial situations (from case studies). The ability to comprehend, analyze, then synthesize and report on financial situations will be stressed.

Oral Communications

Create and effectively deliver oral presentations that are concise and informative and conduct research appropriate to the task at hand. In addition, students will develop active listening skills so they can comprehend complex material and be able to synthesize that material and ask relevant questions.

Learning Outcomes for Learning Skills for the whole course,

The learner will be able to:

- Proceed to graduate work in Finance

- Study independently further topics in western finance

General Pedagogical Methods used for this Program

In general, the Finance modules are taught with a mixture of theory and applied practice. The primary mode for most modules is lecture/discussion. This includes the working of problems based on financial models and discussions of how these models are applied in the financial world. Modules toward the end of the program contain more of a case study format. The use of case studies allows students to experience the application of financial theory and models to real business situations and to explore the results and consequences. This pedagogy, which is standard at the top graduate business schools, is introduced in the advanced modules which allow the students the benefits of this method of study as well as preparing them should they decide to advance to graduate school.

GENERAL ASSESSMENT POLICY AND PROCEDURES

Students must maintain a 2.0/4 grade point average throughout the program. Students whose performance fails to maintain this standard will fall into academic probation. A student in academic probation can continue to enrol in new modules for two semesters, while the student is strongly encouraged to retake modules in which grades were unsatisfactory. If the GPA does not reach the required threshold after two semesters of academic probation, the student may be dismissed from the program.

Students are required to obtain a grade of C- or better in each of the course modules outside of the General Education Component. If a student receives a grade below C-, the students must retake the module in order to graduate.

Assessment Methods:

Assessment methods and policies vary according to each module. They are specified in the description of each module. In general, business core modules are assessed by written examinations and homework assignments. Business major modules are assessed by written examinations, homework assignments and case studies or projects.

At the programme level it is difficult to set criteria for grades, as each module will have different types of tasks. In general, performance can be evaluated on the dimensions of conceptual knowledge, use of evidence and clarity.

Conceptual Knowledge

- Demonstrates mastery of concepts

- Demonstrates knowledge of concepts

- Demonstrates familiarity with concepts

- Demonstrates consistent errors with respect to concepts

- Demonstrates no knowledge of concepts

Use of Evidence

- Cites supporting evidence from multiple sources and addresses evidence that contradicts one’s argument

- Cites evidence from more than one source

- Cites evidence only from assigned reading

- Cites evidence incorrectly

- Does not cite evidence

Clarity

- Assigned structure is followed, no grammatical or spelling errors, point is very clear

- Assigned structure is followed, minor errors, point is clear

- Some variances from assigned structure, minor errors, point is hard to follow

- Some variances from assigned structure, major errors, point is not well made

- Structure is not followed, major errors, no obvious point

Graduation Requirements

In order to graduate with Bachelor of Science in Business & Finance, a student must have completed all modules listed above, with a cumulative GPA of 2/4.

- A student who earns a cumulative grade point average (GPA) of at least 3.850 will be graduated summa cum laude.

- A student who earns a cumulative GPA of at least 3.700 but no higher than 3.849 will be graduated magna cum laude.

- A student who earns a cumulative GPA of at least 3.500 grade but no higher than 3.699 will be graduated cum laude.

RELATIONSHIP TO OCCUPATION/S

This program is highly specialized in business management, and it is at the forefront of knowledge in the field of Business Administration.

Graduates of a quality MBA program not only enter the workforce with higher salaries that other master’s graduates, but also have higher chances of obtaining and holding a high-level management position in their companies. Given the entry requirement of at least three years of working experience, an MBA student finds himself or herself surrounded by professionals who already have established themselves in the working world, and thus enjoy a significant level of networking and connection making. The MBA experience offers professionals who had the opportunity to establish certain routines in their current positions to take a fresh look at their skill sets and dispositions, and to move out of their comfort zone. For all these reasons, AUM considers the MBA as a strategic degree program to offer at the outset, to serve the population working at professional level in Malta, who are looking for the opportunity to obtain a proficient qualification that will significantly enhance their careers at the national and international level.

Graduate students may apply for the following positions in any field such as but not limited to:

– Marketing Manager

– Medical, Educational, Health Services Manager

– Management Consultant

– Financial Manager

– Business Operations Manager

– Accounting Consultant or Manager

– Financial Consultant

– Business Development Consultant

– Tourism Manager

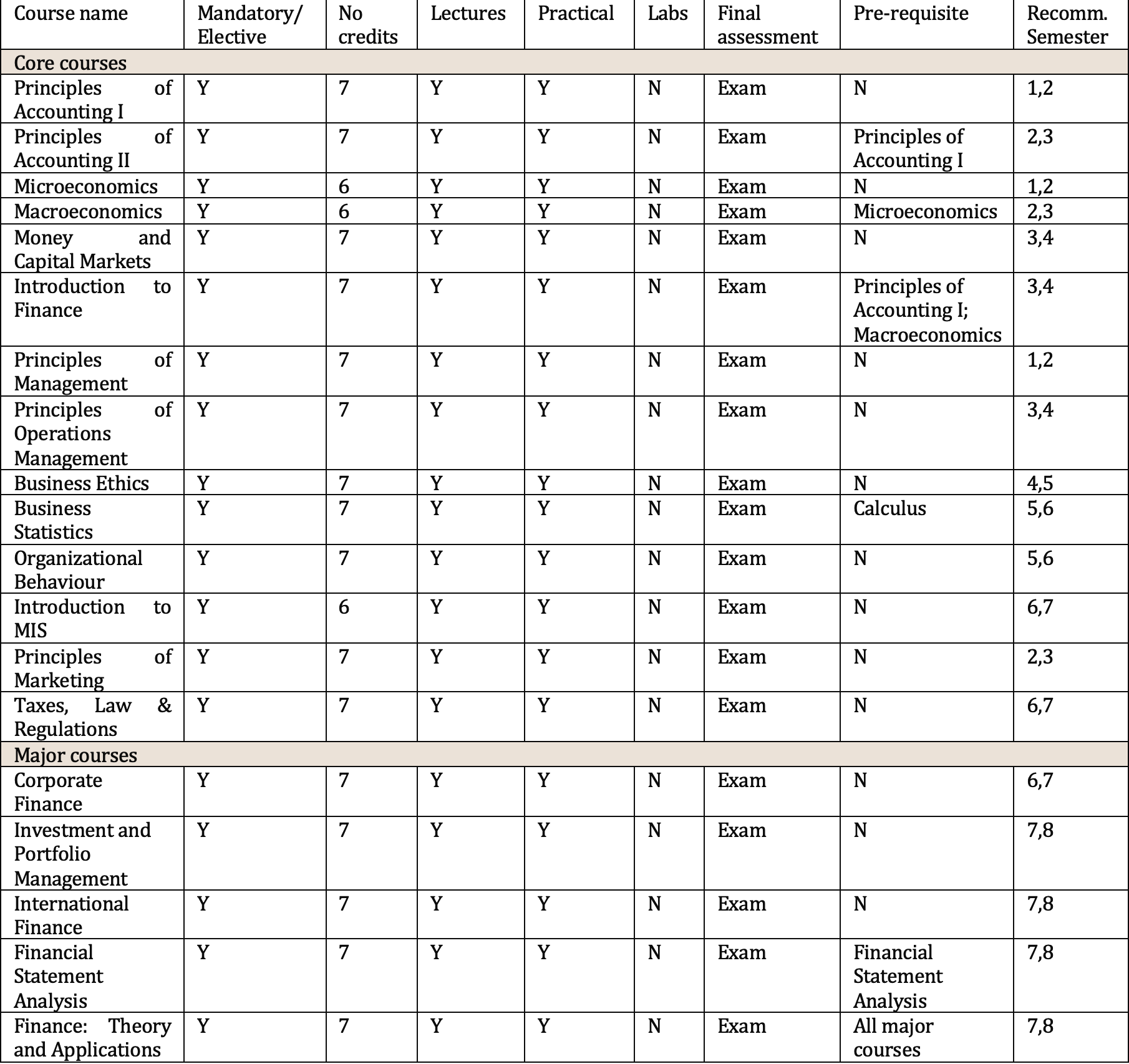

COURSE STRUCTURE SAMPLE

- English Composition 1

- Intro to Statistics

- Microeconomics

- General Education (Elective)

- General Education (Elective)

Semester 2 (16 weeks)

- English Composition 2

- General Education Courses (Elective)

- Principles of Accounting I

- Principles of Management

Semester 3 (16 weeks)

- General Education Courses (compulsory)

- General Education Courses (Elective)

- Principles of Accounting II

- Macroeconomics

- Principles of Marketing

Semester 4 (16 weeks)

- Introduction to Finance

- Business Statistics

- General Education Courses (compulsory)

- General Education Courses (Elective)

Semester 5 (16 weeks)

- General Education (Elective)

- General Education (Elective)

- Organisational Behaviour

- Operations Management

Semester 6 (16 weeks)

- General Education (Elective)

- Management Information System

- Tax Law & Regulations

- Financial Statement Analysis

Semester 7 (16 weeks)

- Corporate Finance

- Money and Markets

- International Finance

- Investment and Portfolio Management

Semester 8 (16 weeks)

- Business Ethics

- Markets Institutions and Derivatives

- Finance: Theory and practice

- General Education (Elective)

Total contact hours: 1372

Supervised practice hours: 37

Self-Study hours: 108

Assessment hours: 2232

Total hours: 217 ECTS

Delivery mode: face-to-face.

Mode of attendance: Full time at AUM premises. Online via MS Teams, and Moodle.

Duration: 4 years

Pass rate: 73%

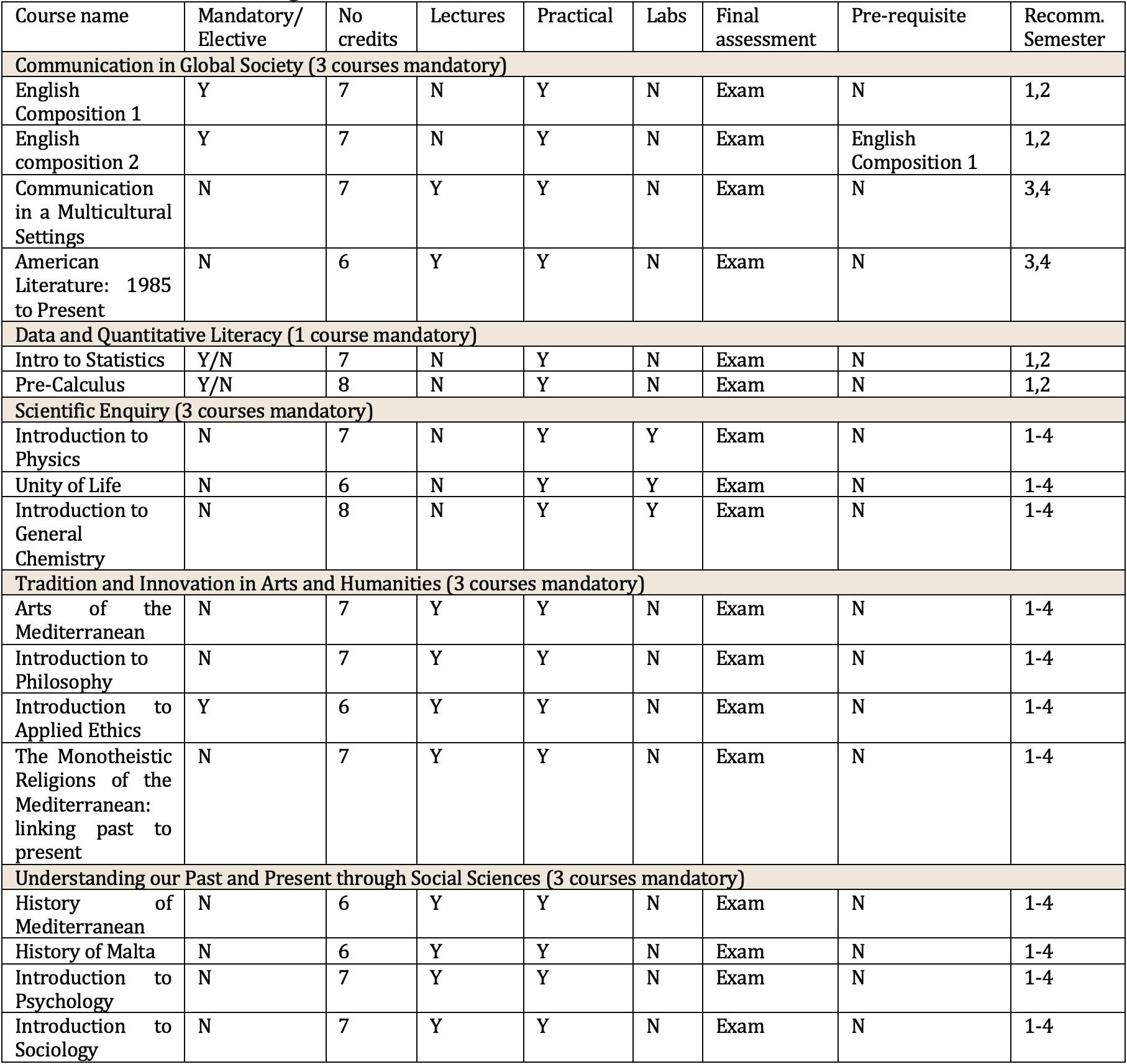

GENERAL EDUCATION